Understanding the Role of AP/AR in Employee Retention

The Strategic Importance of Accounts Payable/Receivable Roles

In today's competitive business environment, employee retention is a critical component of a company's long-term success. The accounts payable and receivable roles are essential to the financial health of an organization. Professionals in these positions manage financial transactions, ensuring cash flow remains steady and customer accounts are accurately maintained.

Accounts Receivable (AR) and Accounts Payable (AP) play strategic roles in maintaining financial stability. These roles are pivotal in accounting and require specialists with strong transactional and cash management skills. An effective job description can significantly influence retention by clarifying the expectations for AR and AP positions.

Understanding these roles is crucial for crafting job descriptions that not only attract qualified candidates but also foster job satisfaction, which is essential for retention. Clearly defining AR and AP tasks, such as processing payments, managing customer accounts, and using automated systems, highlights the specialist's responsibilities and ensures clarity.

Employees in AR and AP roles must possess a strong foundation in financial practices and management. A degree in accounting can provide the necessary qualifications, but practical skills in financial transactions and cash handling are equally important. By defining these expectations upfront, organizations help professionals see their path clearly, which contributes to long-term retention.

Key Elements of an AP/AR Job Description

Core Competencies for AP/AR Roles

Crafting an effective accounts payable and accounts receivable job description is critical for identifying and attracting the right financial professionals. These job roles play a substantial part in managing financial transactions, maintaining healthy cash flow, and ensuring customer satisfaction in a company. Here are some key elements that should be included:- Responsibilities: Clearly outline the tasks associated with the role, such as processing payments, managing customer accounts, and handling financial transactions.

- Qualifications: Specify the required educational credentials, such as a degree in accounting, and essential soft skills. This helps in ensuring the right fit for the job.

- Skills: Highlight necessary skills and competencies. These may include proficiency in automated systems, strong management skills, and attention to detail.

- Role Specifics: Tailor the description to distinguish between more technical roles like payable clerks and receivable specialists, focusing on the unique aspects of each.

Aligning Job Descriptions with Company Culture

Enhancing Job Descriptions to Reflect Company Values

Aligning job descriptions with company culture is essential for fostering a sense of belonging among employees and boosting retention. This requires more than accurately listing the duties of accounts payable and receivable jobs. It involves weaving the company’s values and ethos into the description, making the role not just a job, but a part of a larger, meaningful mission.

A good starting point is to articulate how the accounts receivable specialist or payable clerk roles align with the financial goals and objectives of the company. Such roles are not merely about filling a transactional need—they contribute significantly to the management of cash flow and the overall financial health of the organization. Clarifying this connection can enhance an employee's sense of purpose and engagement.

Moreover, it’s crucial to emphasize the skills qualifications and professional traits that resonate with the company’s culture. For example, if your company values teamwork and customer-centric approaches, these should be reflected in the job description by highlighting the importance of collaboration in managing receivable jobs or the customer focus required of a receivable professional. The more a job description speaks to the values a company holds dear, the more likely you are to attract professionals who not only possess the relevant skills but also share the company’s core ideals.

Automation and technology are increasingly becoming integral to the roles of receivable specialists and payable clerks. Including expectations around proficiency with automated systems within the job description can help align employee skills and training with the company’s operational aims. By doing so, you’ll foster an environment where employees are equipped to grow alongside technological advancements, further enhancing retention by supporting their career development. This approach aligns well with cultivating an engaging work environment that supports long-term employee satisfaction.

Ultimately, infusing job descriptions with clear ties to company culture and goals not only attracts suitable candidates but also builds a workforce that feels in tune with its organizational purpose, thus enhancing employee retention.

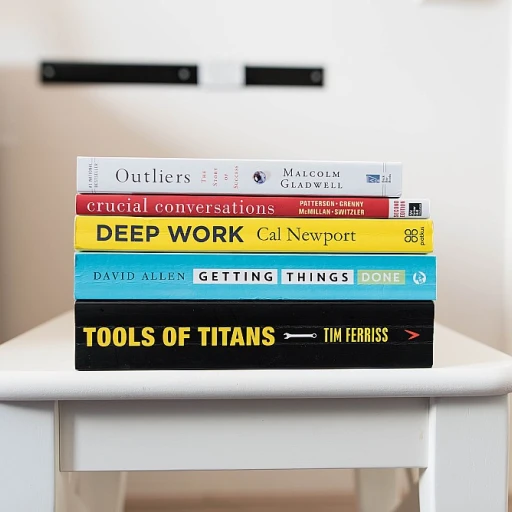

The Role of Career Development in Retention

Prioritizing Career Growth to Support Retention

In the quest to keep talented accounts payable and receivable professionals, fostering career development stands as a critical strategy. When employees perceive a clear path for professional growth, their motivation and loyalty to the company are often heightened. For AP/AR specialists, who may be involved in complex financial tasks such as managing cash flow, processing transactions, and maintaining customer accounts, developing their skills and qualifications can lead to enhanced job satisfaction and reduced turnover. Offering opportunities for career advancement within your organization can significantly impact retention rates. For instance, a comprehensive career development plan might include continued education programs or certifications related to accounting or financial management. Encouraging employees to pursue a degree in accounting or providing specialist job training enhances their expertise, making them feel valued and invested in by the company. Beyond formal education, providing on-the-job learning experiences is equally important. AP/AR professionals involved in receivable jobs may benefit from cross-training initiatives where they can learn about automated systems or new management software being integrated within the company. Such exposure allows them to fill a more versatile role, which in turn contributes to a more dynamic and adaptable workforce. Furthermore, creating a supportive environment where employees know their contributions are recognized can cultivate a sense of self-worth and professional growth. Establishing mentorship programs within the accounts department can also play a significant role in encouraging professional development. When a receivable clerk or accounts payable professional sees a clear growth ladder, the likelihood of them seeking opportunities elsewhere diminishes. Ultimately, the goal is to align the job descriptions of AP/AR roles with developmental aspirations, enabling employees to envision their future within the organization. By doing so, companies not only retain skilled individuals but also build a stronger, more committed team.The Impact of Clear Expectations on Employee Satisfaction

Fostering Clear Communication for Employee Contentment

In the realm of accounts payable and receivable roles, establishing clear expectations is pivotal for employee satisfaction. These financial professionals, whether they're tackling tasks like managing customer accounts, processing cash transactions, or overseeing various receivable jobs, must fully understand their responsibilities. A well-defined job description not only helps clarify duties but also heightens the sense of purpose within their position. When job descriptions articulate specific expectations around accounts management, payment processing, and the use of automated systems, they set the stage for a more cohesive team environment. This clarity fosters confidence in both receivable specialists and payable clerks, enhancing their ability to meet cls (close) financial objectives and support cash flow stability. Moreover, professionals equipped with a comprehensive understanding of their role are better positioned to harness their skills in financial transactions effectively. This alignment is crucial as it empowers employees to handle both daily operations and potential challenges with assurance, knowing exactly how their contributions fit into the larger organizational objectives. Ensuring that employees in roles from payable receivable positions to receivable clerks have access to well-constructed job descriptions not only boosts their task efficiency but also aligns their efforts with company goals. This strategic alignment ultimately leads to improved job satisfaction, enhancing overall employee retention within the company.Adapting Job Descriptions for Remote Work

Tailoring Job Descriptions for the Modern Workspace

As remote work becomes more prevalent, adapting job descriptions for roles such as accounts payable and receivable has become increasingly critical to retain top talent. The transition to remote or hybrid models presents unique challenges and opportunities for financial professionals. Organizations must ensure that job descriptions are crafted to reflect these evolving dynamics and needs.

Remote work requires a different set of skills and qualifications than traditional in-office setups. For instance, management of customer accounts and overseeing financial transactions may need robust command over automated systems. Consequently, highlighting skills in using digital tools and platforms should be a priority in your AP/AR job descriptions.

- Clear Communication: With the shift to virtual communication, roles in accounts payable and receivable require specialists to possess excellent written and verbal communication skills. This ensures smooth cash flow and timely processing of payments in a remote setting.

- Self-Motivation: Employees need to demonstrate initiative in managing their tasks autonomously. It's crucial to include attributes like being self-driven and proactive in the job postings.

- Technology Proficiency: Highlighting proficiency in financial software and digital communication tools is essential. This is vital for managing remote transactions and maintaining accurate financial records.

Providing flexibility and support can boost job satisfaction among payable and receivable professionals, ultimately enhancing employee retention. Moreover, aligning job descriptions with the company's culture of remote work ensures consistency and attracts the right talent.